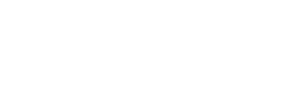

Strategy Updates

I. People & Planet

Friendly Culture

Natural Resources

Our Commitment

Our 2019 Progress

Energy

-6%

Water

-11%

Note: Data covers manufacturing facility of BCF-PH, BCF-INT and Flour only

Natural Resources

Our Commitment

Energy

We will optimize Energy Use Ratio by 30 % by 2030 along with its impact on Carbon Footprint.

Water

Substantially improve water use in our facilities by improving our Water Use Ratio by 30%, by 2030.

Our 2019 Progress

-6%

We have reduced our energy use ratio (EUR) along with its effects to GHG by -6% or equal to 3.65 GJ/metric ton versus our 2018 baseline driven by the improvements from our businesses in the Philippines. We are on track in achieving our 2030 commitments as we further scale our initiatives that drives more efficient use of energy in our value creation while we grow the business.

-11%

Note: Data covers manufacturing facility of BCF-PH, BCF-INT and Flour only

People

Our Commitment

Our 2019 Progress

Growth

In Talent

35

hours

per

employee¹

Safety

-9%

LTIFR²

-26%

AIFR²

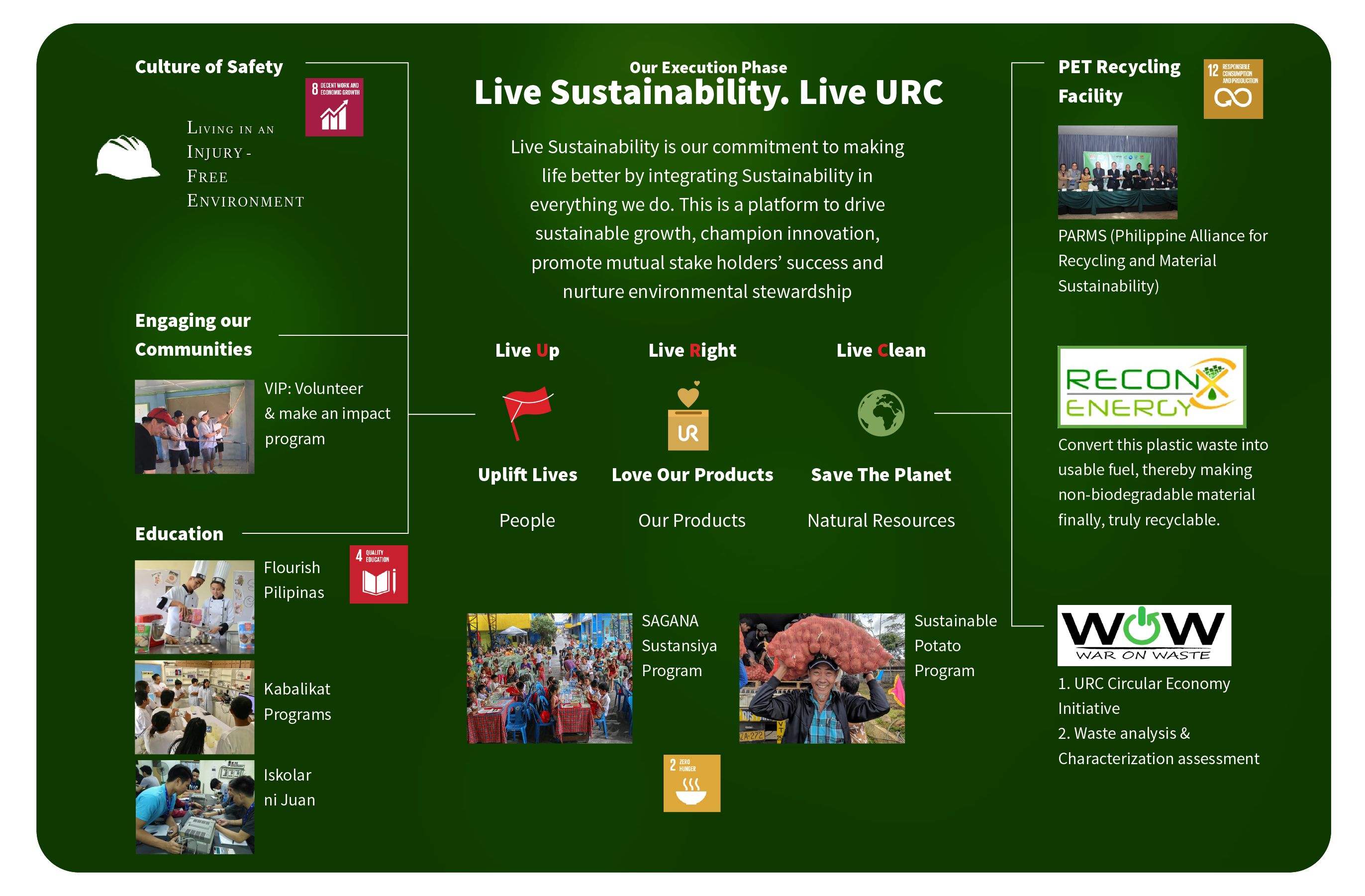

Our Communities

Education:

Live UP

Flourish Pilipinas Kabalikat Program

Nutrition:

Live Right

Sustainable Potato Program

SAGANA Sustansya

Among the 163 undernourished children who participated in the SAGANA Sustansya program in 2019, 155 have improved their nutritional status which led to a 95% overall improvement rate.

We have increased the total number of our volunteers by 157% or equal to 663 employees versus our 2018 baseline as we further promote our coastal cleanup and tree planting initiatives.

Environment:

Live Clean

Coastal Cleanup Tree Planting

2 Data covers manufacturing facility of Total URC

People

Our Commitment

Growth

In Talent

Safety

Our Communities

Our 2019 Progress

35

hours

per

employee¹

-9%LTIFR²

-26%AIFR²

Education:

Live UP

Flourish Pilipinas Kabalikat Program

Nutrition:

Live Right

Sustainable Potato Program

SAGANA Sustansya

Environment:

Live Clean

Coastal Cleanup Tree Planting

We have increased the total number of beneficiaries by 35% or equal to 2,522 individuals versus our 2018 baseline as we develop programs specific to Education and Nutrition. We were able to support teachers and students through Flourish Pilipinas, kabalikat partners through Kabalikat Program, farmers through the Sustainable Potato Program and elementary students through the SAGANA Sustansya Program.

Among the 163 undernourished children who participated in the SAGANA Sustansya program in 2019, 155 have improved their nutritional status which led to a 95% overall improvement rate.

We have increased the total number of our volunteers by 157% or equal to 663 employees versus our 2018 baseline as we further promote our coastal cleanup and tree planting initiatives.

We are on track in achieving our 2030 commitments as we strengthen our communication through better reporting. In 2019, we conducted a roadshow on Live Sustainability, Live URC Framework to help increase the awareness of employees on our CSR metrics.

2 Data covers manufacturing facility of Total URC

Our Products

Our Commitment

Quality

Portfolio

Packaging

Our 2019 Progress

2019: 8 Plants

Total Snack

85%

of SKUs which covered 150 SKUs passed 1 or more than of the URC Wellness Criteria

50%

of SKUs which reformulated 89 SKUs passed 2 or more of the Wellness Criteria

Beverage

86%

or 72 SKUs passed 1 or more of the URC Wellness Criteria

73%

or 61 SKUs passed more than 2 of the URC Wellness Criteria

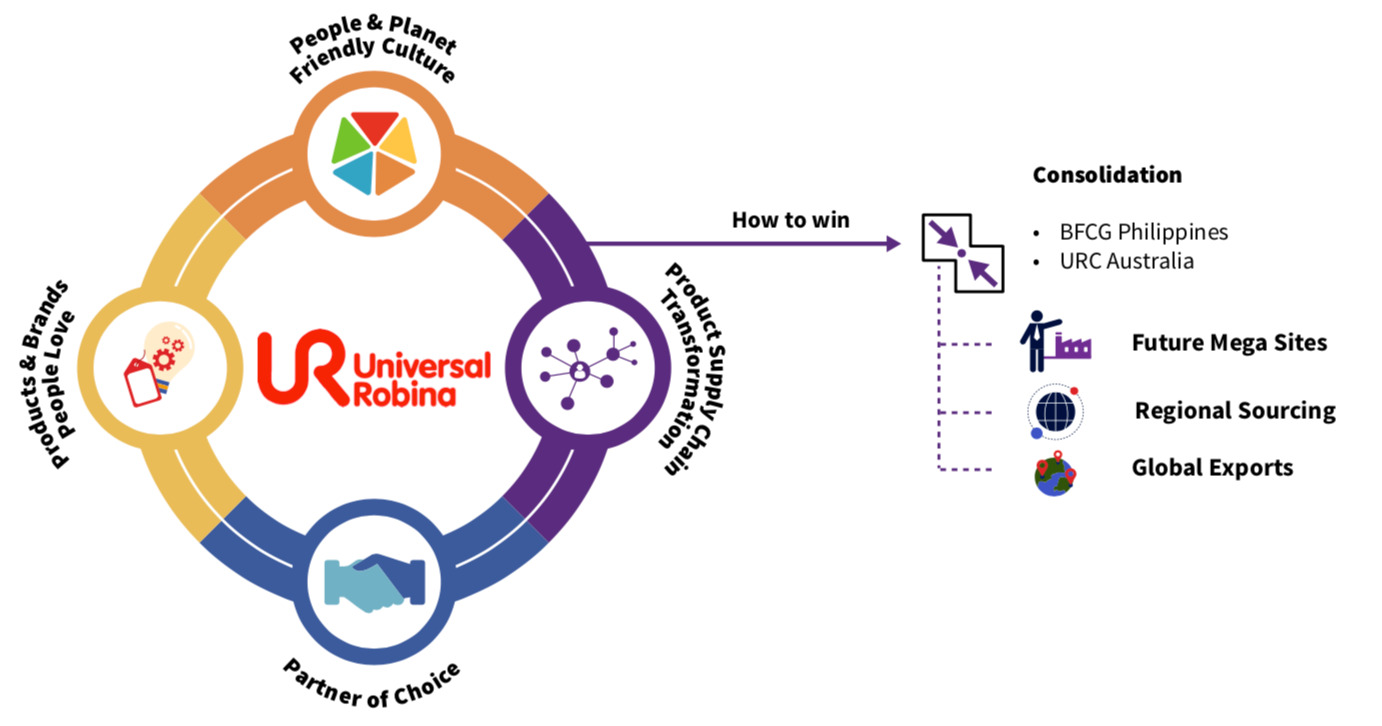

II. Product Supply Chain

Transformation

LEAN Manufacturing Excellence

LEAN Manufacturing

- Successful pilot of Lean in Calamba

- Application of LEAN Mindset in the Philippines

- Philippines Reduced production wastage by 30 bps

- Water & Energy Usage Ratio improved more than 10%

Better Sales & Operations Planning

Supply Network Design (SND)

Our Progress:

III. Partner of Choice

General Trade: Route-To-Market Strategy

Modern Trade Key Accounts: Joint Business Planning

IV. Products & Brands

People Love

When it comes to new flavors, we also launched Chicharon ni Mang Juan, in Classic Chicharon flavor as we continue to re-excite our consumers and further build our extruded snacks category. Internationally, in Thailand, we continue to push new flavors that Thai consumers love as we launched Roller Coaster Spicy Shrimp flavor while in Oceania, we launched the limited edition Thins Himalayan Pink Salt.

In Q4, we relaunched Cloud 9, and we leveraged on the key strength of the brand as we translated it into a new look and campaign.

In our Noodles Category, we continue to strengthen our Nissin Cup Noodles brand by launching a Cheesy Seafood Flavor in Q4 to give consumers a new and exciting experience with their beloved Nissin Seafood Flavor.

We started building our wellness portfolio to serve consumers who are actively looking for better-for-you snacking options. In Q1, we launched Nice & Natural snack bars in the Philippines, Indonesia, and Natural Chip Co. Veggie Rings in Australia.

In Beverages, we launched C2 Plus Fiber in Green Apple and Pineapple flavors, a functional adjacency of our C2 brand that promotes better digestion.

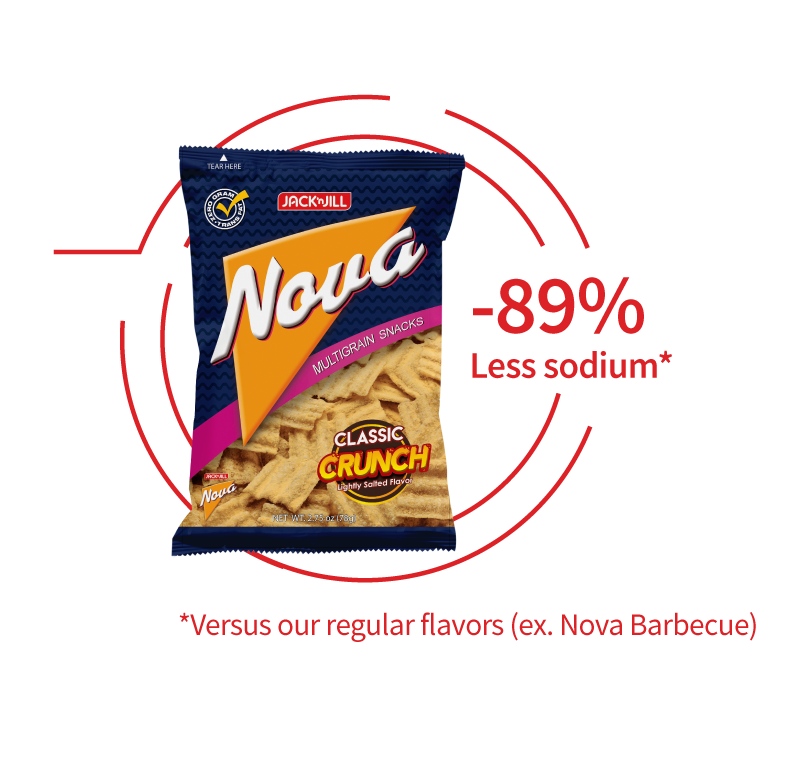

In snacks, we’ve launched a classic crunch version of Nova as our response to a new snacking trend. Nova Classic Crunch has only 90mg per serving of sodium approximately.

Building adjacencies in beverage

Building our Value Added Portfolio in AIC: