Message from the

President

and CEO

To our valued Shareholders,

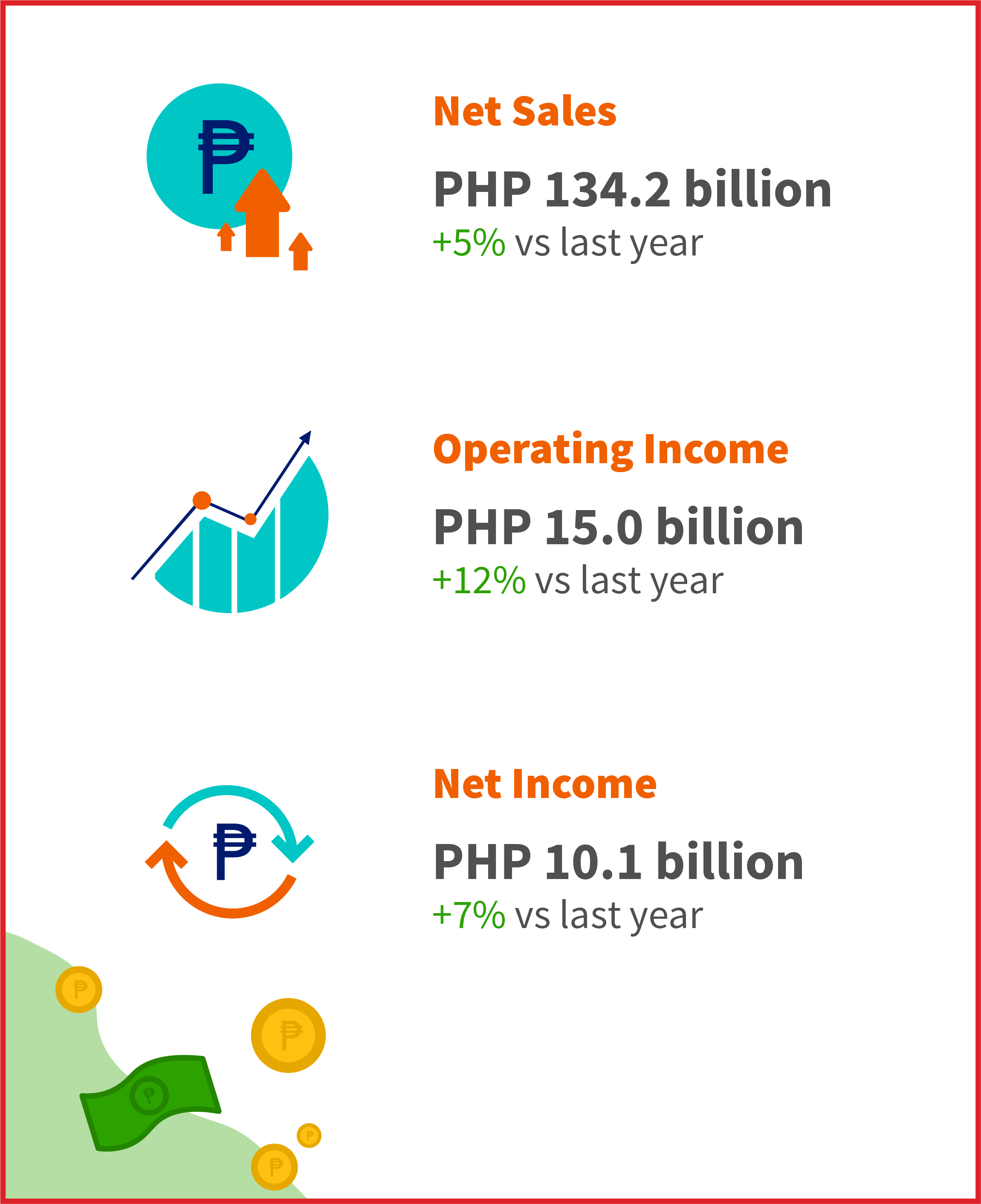

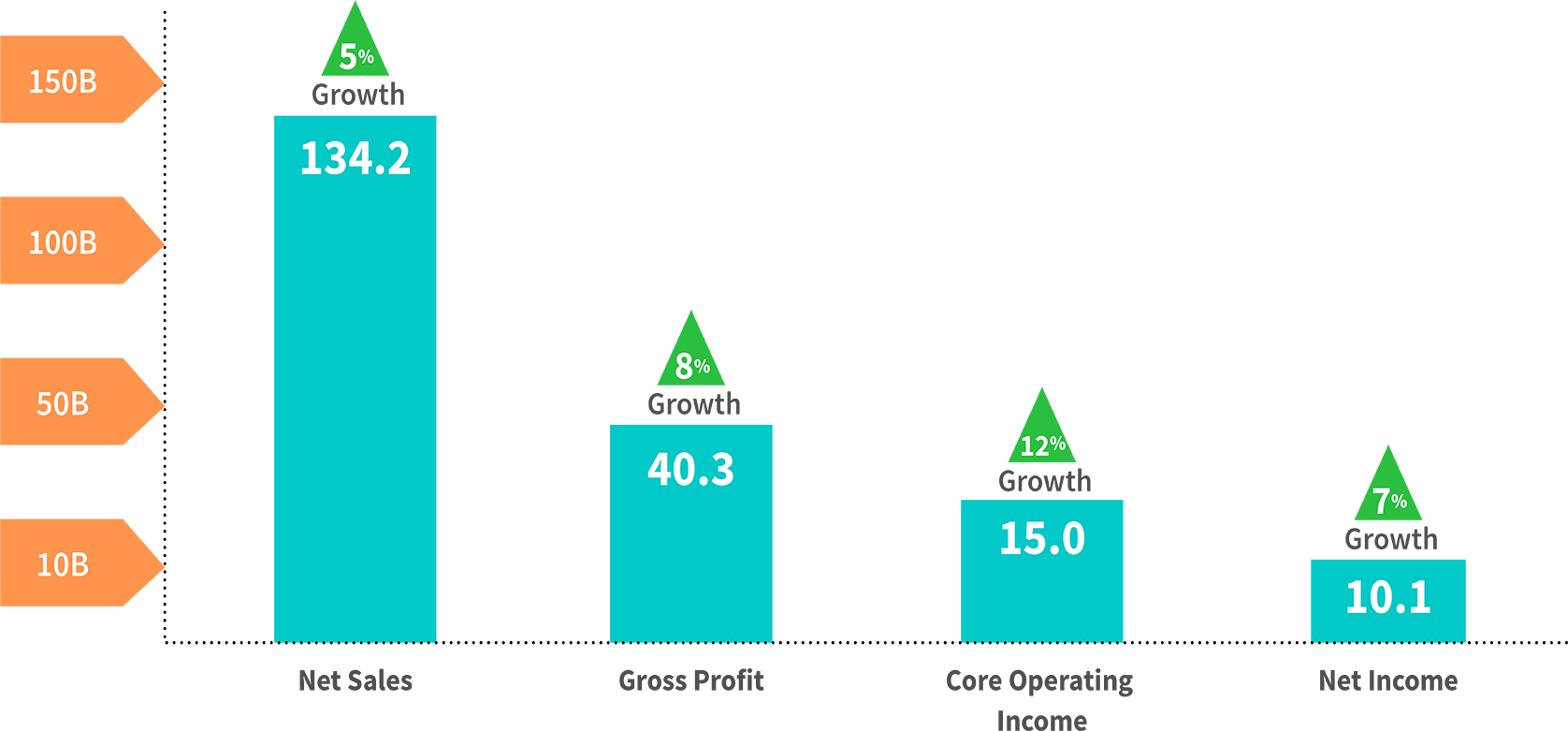

I write this year’s URC annual report letter to you with bittersweet feelings. 2019 marked the end of an era, and at the same time the beginning of a pivotal transformation phase for the company. In November of last year, we sadly lost our beloved founder, Mr. John Gokongwei, Jr. and his wife Elizabeth. In their memory, this annual report will feature elements of how they inspired us and gave us the foundations upon which we continue to build our growth story. Last year, we also saw the beginnings of results delivered from a strategic reboot kicked off in 2018. I am pleased that, in 2019, we achieved strong year-on-year Sales growth of +5% and Operating Income growth of +12%, after three years of profit decline. Importantly, we laid the seeds for sustainable future growth, harvested the first fruits of our labor, and braced ourselves for the exciting journey still to come.

2019 was an important pivot year, and this set a solid base for our glide path back to sustainable growth and profitability. The strategic foundations we built in 2018 enabled URC to focus our execution in 2019. We identified three areas where immediate fixes were needed: (1) turning around the Philippine Coffee business, (2) improving our Sales & Distribution capabilities, and (3) addressing our Product Supply Chain responsiveness and reliability. The progress we made in these areas underpin the strong 2019 results; and are covered in the balance of this report.

These three immediate priorities became the cornerstones of our Where-To-Play and How-To-Win strategies, in our objective to transform URC into a leading sustainable enterprise.

Beyond Coffee, we made choices on protecting and growing our core; finding more adjacencies to expand our portfolio; and strengthening our innovation process management across all categories. Beyond Sales & Distribution, we are transforming our customer and supplier relationships to make URC the preferred partner of choice in our industry. Beyond Supply Chain responsiveness, we are embarking on an ambitious multi-year transformation to capture lean efficiency savings and build a more resilient and cost-effective supply network. And holding all these together is an organizational strategy of building a People and Planet Friendly Culture that permeates our leadership development; positive people experiences; sustainability, quality and safety programs; productivity, simplification and digital acceleration. We have made fast considerable progress in all these strategic areas; and we share some examples of these in this annual report.

This strategic framework provides us a robust set of actions that delivered results last year; and is continuing to deliver results now. Through intensifying competitive challenges … through this pandemic crisis … through thick and thin, fire and brimstone … this strategic framework provides us the guideposts in our quest to transform URC from a successful founder-led company to a leading sustainable enterprise in the Food & Beverage sector for generations to come.

“2019 was an important pivot year and this sets a solid base in our glide path back to sustainable growth and profitability.”

Business Review

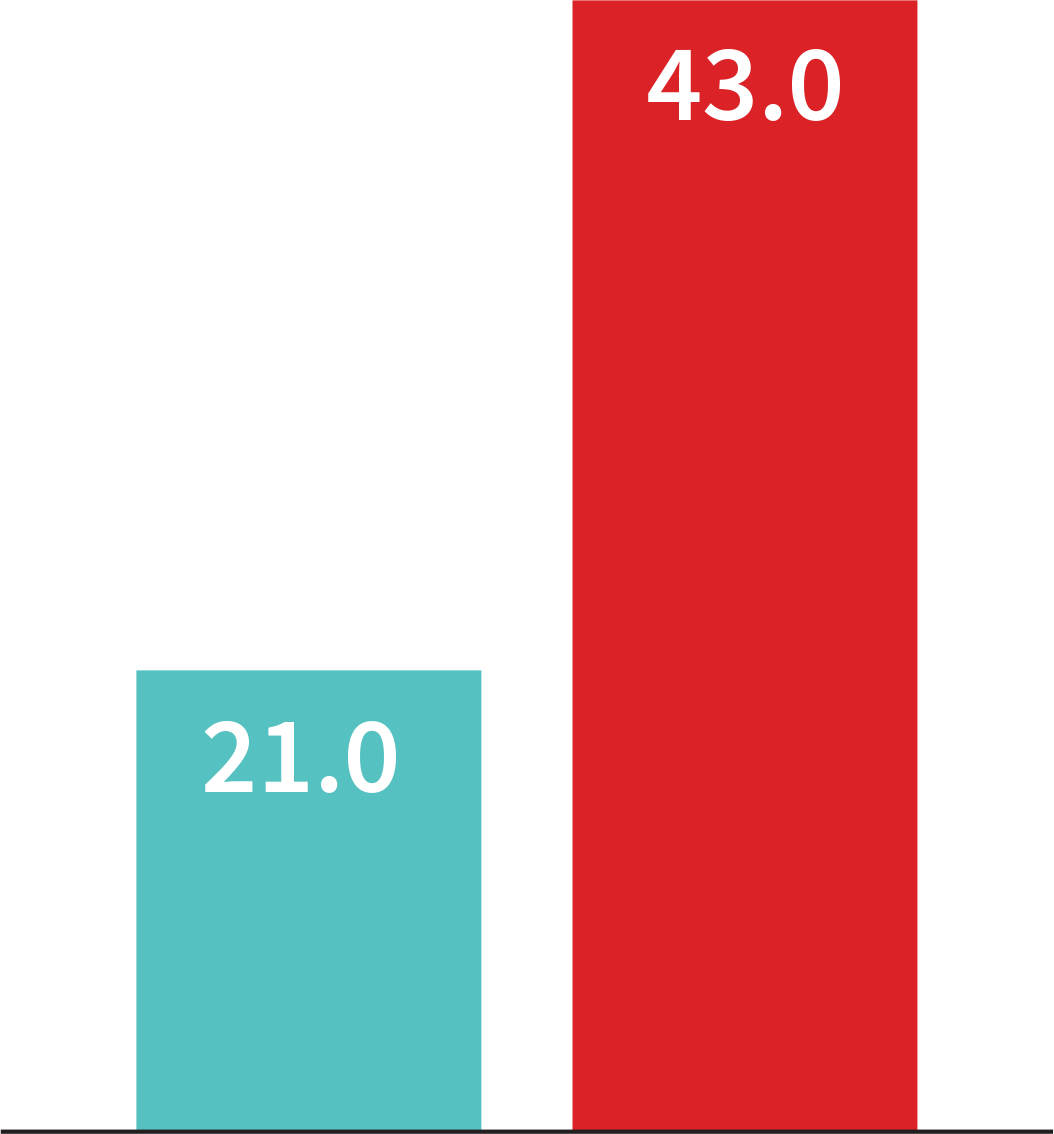

2019 BUSINESS REVIEW: URC OPERATING INCOME UP 12%

“ Our progress in the Philippines drove overall growth in sales as the benefits from our transformation programs started to manifest in our results. ”

“ Our progress in the Philippines drove overall growth in sales as the benefits from our transformation programs started to manifest in our results. ”

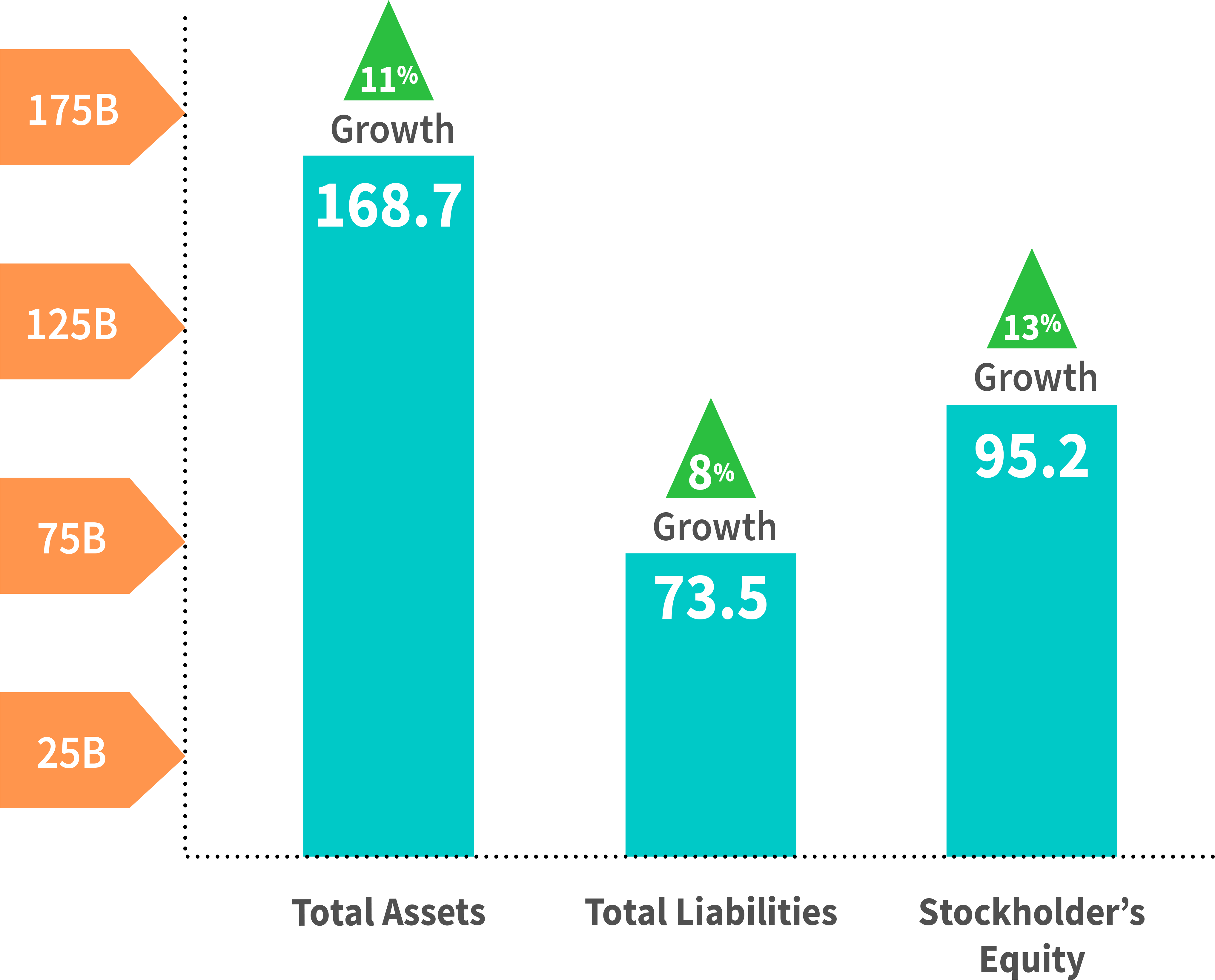

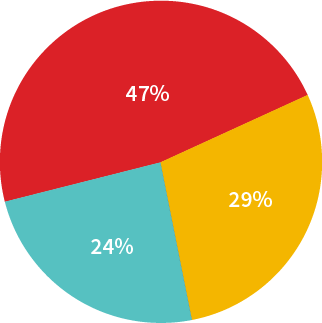

Strong Balance Sheet

URC’s financial position remains strong with ending cash balance of Php 20.5 billion and gearing ratio at a comfortable 0.45 level. Net debt of Php 22.0 billion is mainly attributable to the remaining debt associated with the Oceania acquisitions.

Divisional Performance

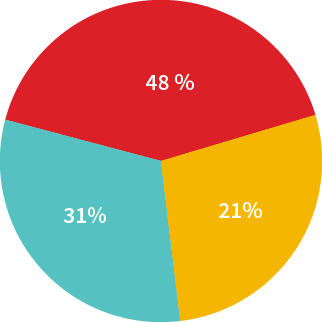

Branded Consumer Foods (BCF) sales, which is composed of domestic and international branded consumer foods, excluding packaging division, grew by 4% versus last year, amounting to Php 104.6 billion.

BCF Philippines' top-line growth has recovered to a healthy 8% growth in 2019 from a flattish performance in the last two years, amounting to Php 62.4B. The good results were driven by the successful turn-around of Great Taste coffee, acceleration of Jack n’ Jill snacks and Noodles, recovery of C2 ready-to-drink tea, and contributions from joint venture businesses with better execution of our crucial transformation programs in distribution and supply chain.

With the steady growth in BCF PH, we have arrested the decline in operating income and slowly regained back our operating leverage. Operating income for BCF Philippines grew at a faster pace than sales at 12% versus last year, amounting to P8.0B driven by higher sales volumes, better mix, and effective OPEX management.

“ We have arrested the decline in operating income and slowly regained our operating leverage. ”

Lastly, our Agro-Industrial & Commodities (AIC) Sales amounted to Php 28.3 billion, a 12% increase versus last year while operating income grew by 12%. The Agro-Industrial Group increased sales by 12%, driven mainly by strong growth in Animal Nutrition & Health (animal feeds and pet food). The Commodities Foods Group revenue grew by 12% with Flour posting a healthy 26% sales growth while Sugar & Renewables (SURE) increased by 6% versus last year. Operating income grew by 12%, amounting to Php 4.9B driven by Flour and Animal Nutrition & Health (formerly called Feeds); however, this was offset by a significant decline in the hogs industry.

Income Statements 2019

Balance Sheet 2019

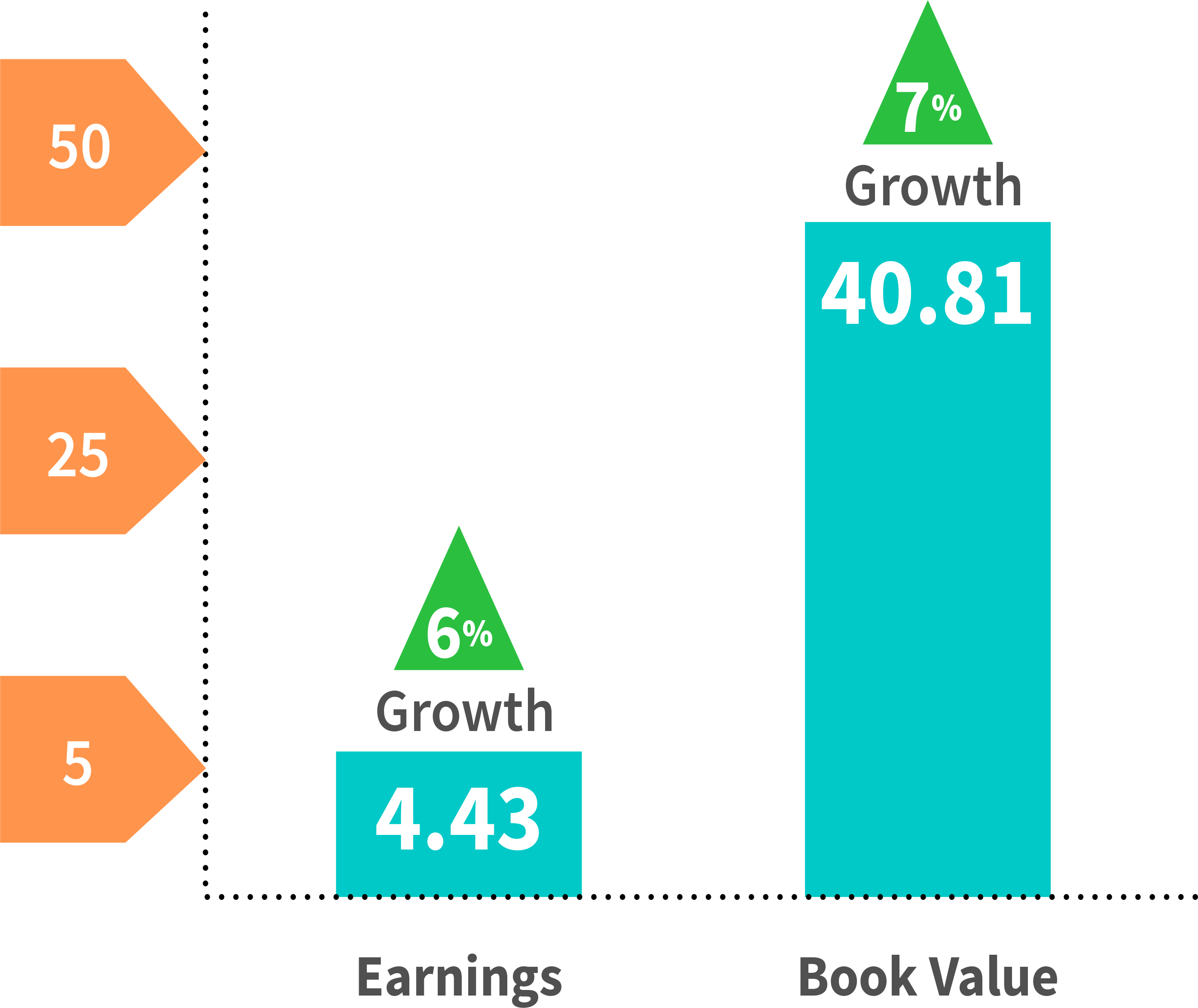

Per Share 2019

Amounts in billion Peso except per share data

Core Operating Income includes revaluation of biological assets

Sales

Philippines

International

Agro-industrial

and commodities

EBIT*

Philippines

International

Agro-industrial

and commodities

*EBIT includes revaluation of biological assets but excludes corporate expenses

Cash Position

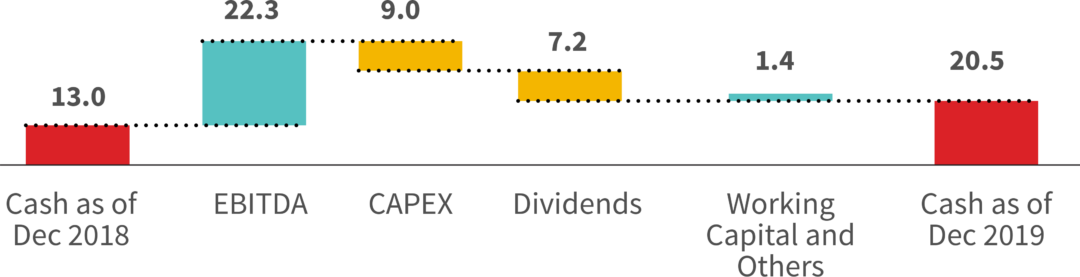

Cash and Financial Debt

CY 2018

Cash + Financial Assets

at FVPL + APS

CY 2019

Financial Debt

Other Updates

Intersnack Transaction

Restructuring Reserves

We have included in our 2019 financials, non-cash restructuring reserve charges of Php830 Million before tax and Php 581 Million after tax. The nature of these Restructuring Reserves relates to strategic decisions taken in 2019 involving multi-year restructuring programs that will be executed over the next 2-3 years. The strategic decisions are a result of choices in specific Where-To-Play (portfolio streamlining) and How-To-Win (product supply chain transformation) areas of our strategic framework:

- Supply Network Design (SND) Consolidations – Last year we completed detailed SND studies to determine the optimal configuration of our plant facilities. These studies indicated the opportunity to improve long term cost efficiencies, while supporting future business expansion, by consolidating some of our excess high cost factories. This will entail closures, asset write offs and redundancies in the Philippines and Australia over the next 2-3 years, resulting in production cost efficiency benefits thereafter.

- Portfolio Adjustment / Downsizing of Farms – Over the past year and a half, we have engaged all business units in strengthening our core categories and identifying more new categories to develop. As part of this strategic assessment, we have determined that the Agro-Industrial Group (AIG) will be best served by focusing on the profitable and growing Animal Nutrition & Health business and continue to move up the value-added chain in the meat business. The latter means developing our new packaged meat offerings and downsizing in the highly volatile and difficult bio-security livestock farm facilities. We will still participate in the hog farms segment for vertical integration resiliency; but we no longer need as much hog farms and breeder stocks as we have today. This downsizing will progress over the coming year, resulting in reduced losses and volatility from the farm business.

In Closing

“ Shifting to the future and what might be the new normal, we remain well-positioned in the long term to serve consumers and create value in attractive business segments ”

“ We are fortunate to be in the food industry with a strong balance sheet and healthy cash position. ”

We are fortunate to be in the food industry with a strong balance sheet and healthy cash position. We are confident we can weather the challenges posed by COVID-19. The best response to this crisis is to push forward, not to pull back, and that’s exactly what we intend to do. We’re doubling down to serve consumers and our communities. We’re doing this in our interest and society’s interest, and in the interest of our long-term shareholders.

We want to express our most profound appreciation to you, our shareholders, for your continued confidence and support to URC.

Thank you very much.

Irwin C. Lee

PRESIDENT & CEO