Message from the President and CEO

To our valued Shareholders,

I am delighted to report that URC has successfully navigated another challenging year.

The challenges were plenty. A volatile economic landscape caused in part by ongoing conflicts in the Middle East and Europe, as well as major and unpredictable shifts in international trade. Heightened supply pressures fueled by crop availability concerns and climate change. Shifting consumer behaviors, as people continue to adjust their purchase choices due to inflation.

The changes and transitions pressed hard on us. But URC was characteristically ready and energized in these difficult conditions.

By recognizing that change is truly the one constant – in business and life – we’ve been able to come out on top by embracing change and strategically navigating transitions.

It’s this mindset that has allowed us to respond to change with an attitude of courage. Courage that powers us through hard times, knowing that we’ve got the talent, creativity, resources, and beloved brands to rise to the occasion.

This, bolstered by our strategic agility, operational excellence, and an unwavering commitment to innovation, birthed many opportunities in 2024 --- breaks that we capitalized on and turned into catalysts for growth.

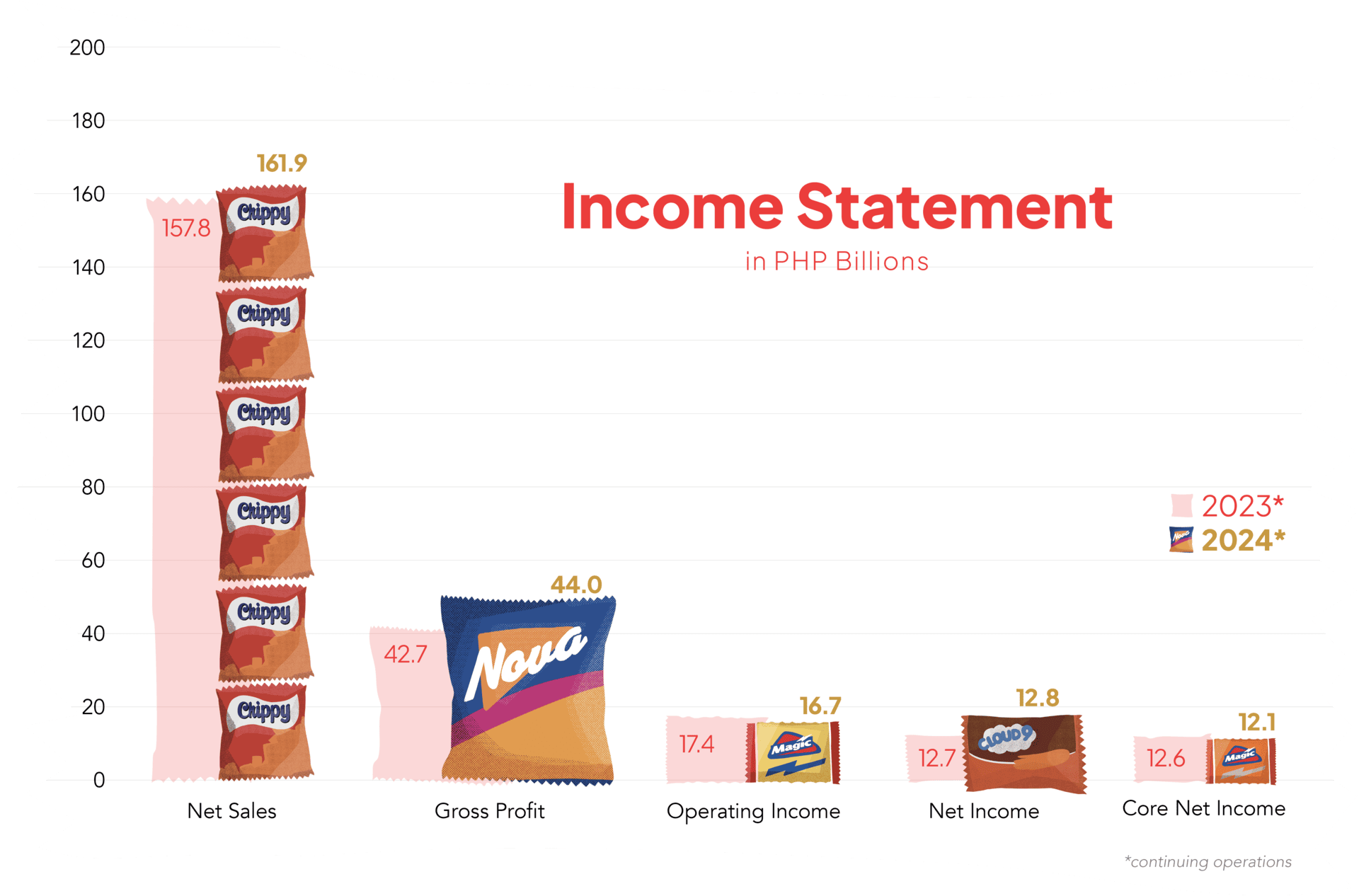

We delivered Php161.9 billion in revenue from continuing operations, marking a 3% increase from the previous year, as our international business continues to drive strong growth, balancing out a more challenging domestic environment. Our operating income of Php16.7 billion reflected a 4% decline year-on-year, an expected result as our Sugar and Renewables segment profits corrected after an unusually high profit in 2023.

More importantly, our core branded food and beverage businesses posted an outstanding 19% increase in operating income, expanding margins by nearly 200 basis points.

This achievement underscores the strength of our beloved brands, our ability to innovate, and our relentless focus on delivering value to our customers.

We were able to successfully navigate change because of our equal commitment to the betterment of our people, partners, and communities.

We’ve continued to push a range of employee enrichment initiatives, from leadership, technical, and agile learning programs to AI-enhanced tools for real-time employee support.

We’ve also maintained our focus on sustainability projects, not forgetting the need to protect and preserve the environment which makes so much of our success possible.

As we pivot toward 2025, we remain steadfast in our commitment towards sustainable growth, operational efficiency, and market leadership.

possible because of our equal commitment to the

betterment of our people, partners, and communities.

To our valued Shareholders,

I am delighted to report that URC has successfully navigated another challenging year.

The challenges were plenty. A volatile economic landscape caused in part by ongoing conflicts in the Middle East and Europe, as well as major and unpredictable shifts in international trade. Heightened supply pressures fueled by crop availability concerns and climate change. Shifting consumer behaviors, as people continue to adjust their purchase choices due to inflation.

The changes and transitions pressed hard on us. But URC was characteristically ready and energized in these difficult conditions.

By recognizing that change is truly the one constant – in business and life – we’ve been able to come out on top by embracing change and strategically navigating transitions.

It’s this mindset that has allowed us to respond to change with an attitude of courage. Courage that powers us through hard times, knowing that we’ve got the talent, creativity, resources, and beloved brands to rise to the occasion.

This, bolstered by our strategic agility, operational excellence, and an unwavering commitment to innovation, birthed many opportunities in 2024 --- breaks that we capitalized on and turned into catalysts for growth.

We delivered Php161.9 billion in revenue from continuing operations, marking a 3% increase from the previous year, as our international business continues to drive strong growth, balancing out a more challenging domestic environment. Our operating income of Php16.7 billion reflected a 4% decline year-on-year, an expected result as our Sugar and Renewables segment profits corrected after an unusually high profit in 2023.

More importantly, our core branded food and beverage businesses posted an outstanding 19% increase in operating income, expanding margins by nearly 200 basis points.

This achievement underscores the strength of our beloved brands, our ability to innovate, and our relentless focus on delivering value to our customers.

We were able to successfully navigate change because of our equal commitment to the betterment of our people, partners, and communities.

We’ve continued to push a range of employee enrichment initiatives, from leadership, technical, and agile learning programs to AI-enhanced tools for real-time employee support.

We’ve also maintained our focus on sustainability projects, not forgetting the need to protect and preserve the environment which makes so much of our success possible.

As we pivot toward 2025, we remain steadfast in our commitment towards sustainable growth, operational efficiency, and market leadership.

Our mission to create opportunity has been only possible because of our equal commitment to the betterment of our people, partners, and communities.

Divisional Performance

In 2024, our Branded Consumer Foods (BCF) Philippines division focused on driving volume-based revenue growth.

We prioritized product innovation, value offerings, and competitive marketing strategies. Despite economic headwinds, we observed positive momentum as we closed out 2024. Most brands delivered volume and value growth, with rapid increase seen in value-for-money segments as our initial value interventions launched in the year are also performing well. Overall, this demonstrates an improving consumer landscape as we head into 2025.

Our BCF International business unit continued to be a growth engine, as topline and operating profit from continuing operations grew by 8% and 43%, respectively. Our key brands in the region did exceptionally well as we expanded market shares across key categories in Southeast Asia. C2 is now competing head-to-head with the market leader as the #1 ready-to-drink tea brand in Vietnam; we’re also leading the biscuits category in Malaysia, cementing our position as the #1 manufacturer with the integration of Munchy’s into our portfolio.

Rounding out URC’s international success are our maintained strong market-leading positions in the biscuits and coated wafers categories in Thailand and the significant gains we had in Indonesia in snacks and biscuits. The solid performance of our core products, combined with the new innovative offerings, fueled our growth in these countries.

Our focus on product innovation and localization strategies allowed us to sustain strong performance across the markets in Southeast Asia. Moving forward, our strategy is to scale Munchy’s further and build additional growth pillars in each of the countries.

The Agro-Industrial and Commodities (AIC) business unit delivered 5% topline growth for the year, driven by higher volumes across most of its segments.

Agro-Industrial Group (AIG) successfully navigated a challenging Philippine market in 2024. Growth in our Animal Nutrition & Health (ANH) remains steady despite a nearly 10% decline in the swine population and price rollbacks by major feed competitors. We also made strides in expanding our pet food business, reinforcing our leadership in dry dog food while actively building our cat food portfolio.

Flour revenues remained steady, with strong volume gains offsetting our competitive pricing adjustments. Meanwhile, Sugar and Renewables (SURE) saw a 13% increase, driven by accelerated sell-through of accumulated inventories.

On the operating income front, both AIG and Flour improved their margins, with a stronger cost base counterbalancing our price adjustments. SURE experienced a correction in 2024 following its record-breaking 2023 performance, with the clearance of high-cost inventories as well as a delayed start to the latest milling season.

And while the profitability of our Commodities business is normalizing, we are actively focused on sustainable cash generation in 2025.

Divisional Performance

In 2024, our Branded Consumer Foods (BCF) Philippines division focused on driving volume-based revenue growth.

We prioritized product innovation, value offerings, and competitive marketing strategies. Despite economic headwinds, we observed positive momentum as we closed out 2024. Most brands delivered volume and value growth, with rapid increase seen in value-for-money segments as our initial value interventions launched in the year are also performing well. Overall, this demonstrates an improving consumer landscape as we head into 2025.

Our BCF International business unit continued to be a growth engine, as topline and operating profit from continuing operations grew by 8% and 43%, respectively. Our key brands in the region did exceptionally well as we expanded market shares across key categories in Southeast Asia. C2 is now competing head-to-head with the market leader as the #1 ready-to-drink tea brand in Vietnam; we’re also leading the biscuits category in Malaysia, cementing our position as the #1 manufacturer with the integration of Munchy’s into our portfolio.

Rounding out URC’s international success are our maintained strong market-leading positions in the biscuits and coated wafers categories in Thailand and the significant gains we had in Indonesia in snacks and biscuits. The solid performance of our core products, combined with the new innovative offerings, fueled our growth in these countries.

Our focus on product innovation and localization strategies allowed us to sustain strong performance across the markets in Southeast Asia. Moving forward, our strategy is to scale Munchy’s further and build additional growth pillars in each of the countries.

The Agro-Industrial and Commodities (AIC) business unit delivered 5% topline growth for the year, driven by higher volumes across most of its segments.

Agro-Industrial Group (AIG) successfully navigated a challenging Philippine market in 2024. Growth in our Animal Nutrition & Health (ANH) remains steady despite a nearly 10% decline in the swine population and price rollbacks by major feed competitors. We also made strides in expanding our pet food business, reinforcing our leadership in dry dog food while actively building our cat food portfolio. Flour revenues remained steady, with strong volume gains offsetting our competitive pricing adjustments. Meanwhile, Sugar and Renewables (SURE) saw a 13% increase, driven by accelerated sell-through of accumulated inventories.

On the operating income front, both AIG and Flour improved their margins, with a stronger cost base counterbalancing our price adjustments. SURE experienced a correction in 2024 following its record-breaking 2023 performance, with the clearance of high-cost inventories as well as a delayed start to the latest milling season.

And while the profitability of our Commodities business is normalizing, we are actively focused on sustainable cash generation in 2025.

2024

Financial Highlights

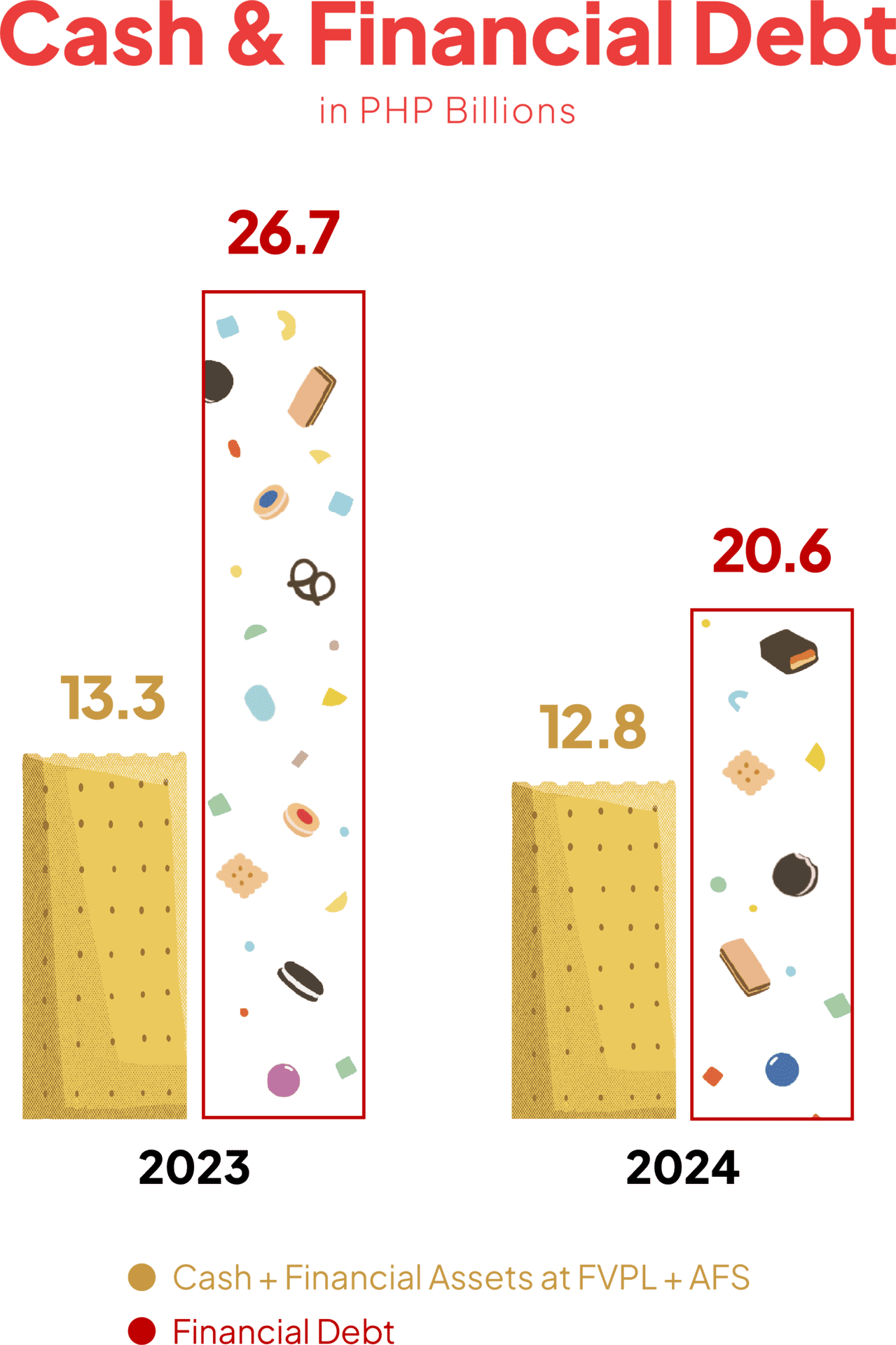

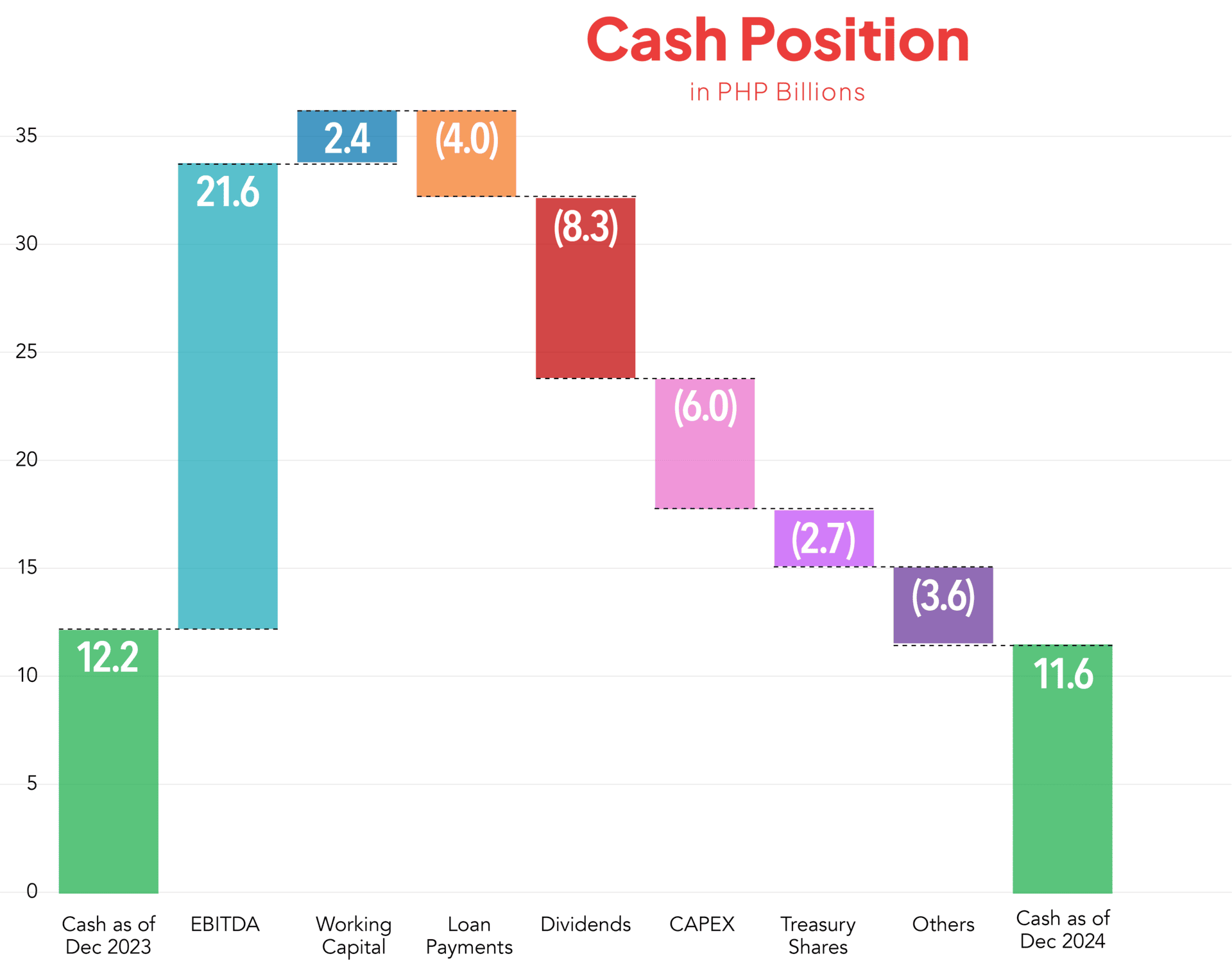

Cash & Financial Debt

Cash Position

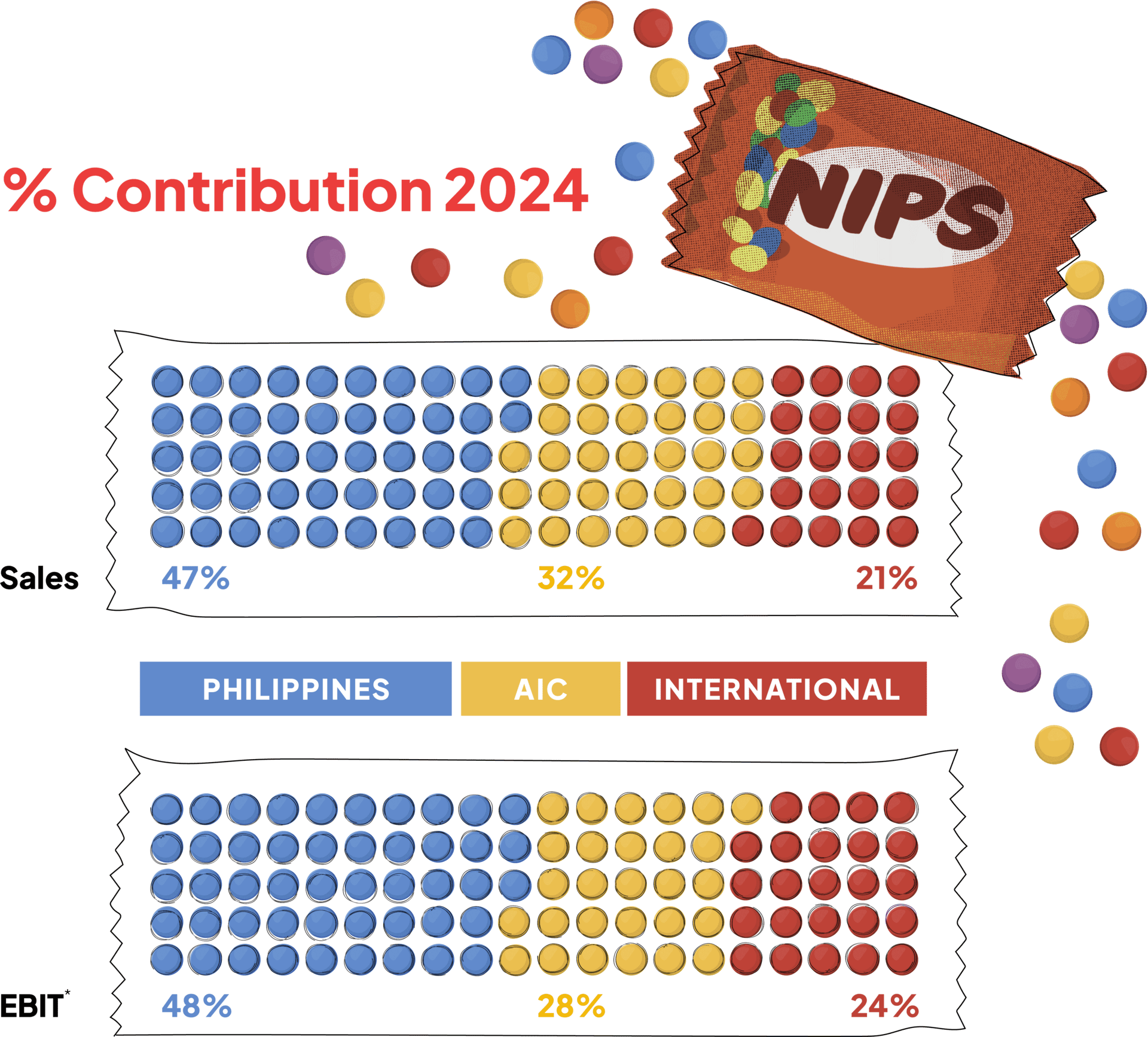

% Contribution 2024

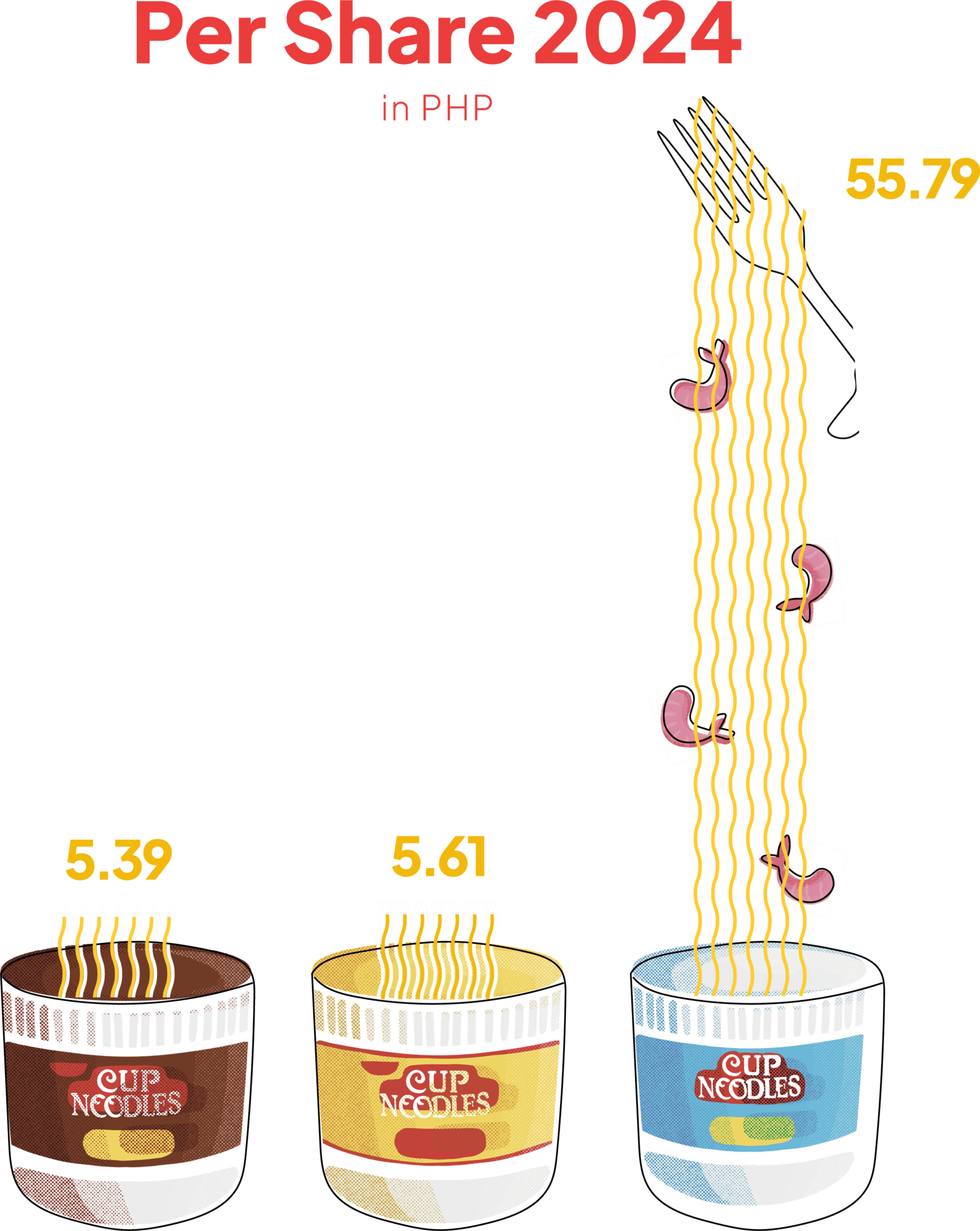

Per Share 2024

Other Updates

Beyond financial performance, 2024 was a year of strategic growth and organizational transformation.

Product Innovations

We pursued a number of product innovations that have generated success in both domestic and international markets. Our innovation pipeline continues to drive development of consumer- serving products, addressing key consumption moments and preference.

Over the last few years, with the growing demand for value-for-money options, we have developed quality products at affordable price points. In the Philippines, we launched Payless Sakto and Piattos Fun Pack – the same brand quality in smallersized options and a lower cost to entry.

Other innovations addressed changing consumer behavior, such as the rise of onthe-go consumption moments. Lush Sour, a soft candy in a convenient stand-up pouch. Great Taste Iced Coffee Dark Latte expanded our ready-to-drink coffee options, with café quality in a convenient out-of-home format.

Unique flavor and segment extensions such as C2 Peach, Dewberry yoghurt cakes, and the Piattos Special Edition lineup (with limited-availability variants such as Truffle, Bulgogi, and Four Cheese) provided new taste opportunities for adventurous gourmets.

Finally, reinforcing health and wellness was a priority, while still offering tasty products. By using moringa as a key ingredient, we were able to expand the country’s #1 healthy snack by launching Nova Green, and entered the healthy coffee segment with Blend 45 Malunggay. We also excited the cultured milk drink market by distributing Goodday, and transforming that immunityboosting product into a credible market challenger.

Other Updates

Product Innovations

Beyond financial performance, 2024 was a year of strategic growth and organizational transformation.

We pursued a number of product innovations that have generated success in both domestic and international markets. Our innovation pipeline continues to drive development of consumer- serving products, addressing key consumption moments and preference.

Over the last few years, with the growing demand for value-for-money options, we have developed quality products at affordable price points. In the Philippines, we launched Payless Sakto and Piattos Fun Pack – the same brand quality in smallersized options and a lower cost to entry.

Other innovations addressed changing consumer behavior, such as the rise of onthe-go consumption moments. Lush Sour, a soft candy in a convenient stand-up pouch. Great Taste Iced Coffee Dark Latte expanded our ready-to-drink coffee options, with café quality in a convenient out-ofhome format.

Unique flavor and segment extensions such as C2 Peach, Dewberry yoghurt cakes, and the Piattos Special Edition lineup (with limited-availability variants such as Truffle, Bulgogi, and Four Cheese) provided new taste opportunities for adventurous gourmets.

Finally, reinforcing health and wellness was a priority, while still offering tasty products. By using moringa as a key ingredient, we were able to expand the country’s #1 healthy snack by launching Nova Green, and entered the healthy coffee segment with Blend 45 Malunggay. We also excited the cultured milk drink market by distributing Goodday, and transforming that immunityboosting product into a credible market challenger.

Developments were not limited to the Philippines, as new products have also taken off across Southeast Asia. Key among these successes has been the expansion of the Munchy’s portfolio outside of Malaysia, and our success turning Lexus and Oat Krunch into the tip of the spear of our biscuits play in Indonesia. Other innovative wins include Fun-O Lava, Roller Coaster Corn Snack, Dewberry Fruit Pie, and Tivoli Big Bomb in Thailand; Lexus Gold, Roller Coaster Crisps, and Cream-O Plain Sweet Biscuit in Malaysia; and C2 Pink Guava, C2 Green Tea Lychee, and Rong Do Peach Yuzu in Vietnam.

We also expanded our TopBreed pet food portfolio with new pack sizes for the modern trade, which have been received well by both retailers and consumers. We have also made a concerted push into new segments such as cat food, providing the same quality TopBreed products – now formulated for felines.

The reception to these products has been very positive and we’re excited to continue building more innovations in the years to come. As always, we follow vibrant market signals where they lead us; watch this space for more.

Sariaya Flour Mill Opening

This milestone will enhance our supply chain efficiency and reinforce our ability to meet growing demand and cater untapped markets. It’s important that we shore up capacity in this segment as flour is a critical product, with ever-expanding growth potential.

Leadership Reorganization

We made strategic leadership shifts to strengthen our core business, which will take effect in 2025. Mian David, previously head of URC International, transitioned to lead BCF Philippines. David Lim, previously our Chief Supply Chain and Sustainability Officer, took on the role of Chief Technology Officer, overseeing research & development and corporate engineering. Meanwhile, Jess Panis stepped into David’s vacated role as Chief Supply Chain and Sustainability Officer; Jess was most recently Vice President for Integrated Supply Chain. Finally, Pancho Del Mundo expanded his role as Chief Finance and Strategy Officer.

These key leaders, accomplished and ready to take on new challenges in 2025 and beyond, will drive innovation, strengthen market leadership, and sustain URC’s long term growth.

Developments were not limited to the Philippines, as new products have also taken off across Southeast Asia. Key among these successes has been the expansion of the Munchy’s portfolio outside of Malaysia, and our success turning Lexus and Oat Krunch into the tip of the spear of our biscuits play in Indonesia. Other innovative wins include Fun-O Lava, Roller Coaster Corn Snack, Dewberry Fruit Pie, and Tivoli Big Bomb in Thailand; Lexus Gold, Roller Coaster Crisps, and Cream-O Plain Sweet Biscuit in Malaysia; and C2 Pink Guava, C2 Green Tea Lychee, and Rong Do Peach Yuzu in Vietnam.

We also expanded our TopBreed pet food portfolio with new pack sizes for the modern trade, which have been received well by both retailers and consumers. We have also made a concerted push into new segments such as cat food, providing the same quality TopBreed products – now formulated for felines.

The reception to these products has been very positive and we’re excited to continue building more innovations in the years to come. As always, we follow vibrant market signals where they lead us; watch this space for more.

Sariaya Flour Mill Opening

This milestone will enhance our supply chain efficiency and reinforce our ability to meet growing demand and cater untapped markets. It’s important that we shore up capacity in this segment as flour is a critical product, with ever-expanding growth potential.

Leadership Reorganization

We made strategic leadership shifts to strengthen our core business, which will take effect in 2025. Mian David, previously head of URC International, transitioned to lead BCF Philippines. David Lim, previously our Chief Supply Chain and Sustainability Officer, took on the role of Chief Technology Officer, overseeing research & development and corporate engineering. Meanwhile, Jess Panis stepped into David’s vacated role as Chief Supply Chain and Sustainability Officer; Jess was most recently Vice President for Integrated Supply Chain. Finally, Pancho Del Mundo expanded his role as Chief Finance and Strategy Officer.

These key leaders, accomplished and ready to take on new challenges in 2025 and beyond, will drive innovation, strengthen market leadership, and sustain URC’s longterm growth.

Opportunities Ahead

Looking to 2025, we remain focused on volume-driven revenue growth and market share expansion in the Philippines. We’re also very bullish about our international business. We foresee a strong growth trajectory in Southeast Asia, particularly with the further scaling of Munchy’s. Our Commodities business will center on profit recovery and sustainable cash generation, ensuring long-term stability.

We will also deepen our investments in branded products, including Animal Nutrition and Health, reinforcing our leadership in a variety of categories. We remain committed to brand-building, value innovations, and enhanced marketing investments to support greater growth in the coming years.

“

We need to rise above the changes at hand and build, shape, and cultivate success with purpose and precision.

All of these efforts emphasize our dedication to navigate the transitions that so readily come with change. This includes an eager willingness to drive new success, no matter the challenge.

We need to rise above the changes at hand and build, shape, and cultivate success with purpose and precision. We have laid the groundwork, and now, with our best talent, strongest brands, and most ambitious strategies in play, we are poised to seize every new opportunity in the years ahead. Thank you for your continued trust and support.

Irwin C. Lee

President & CEO

Opportunities Ahead

Looking to 2025, we remain focused on volume-driven revenue growth and market share expansion in the Philippines. We’re also very bullish about our international business. We foresee a strong growth trajectory in Southeast Asia, particularly with the further scaling of Munchy’s. Our Commodities business will center on profit recovery and sustainable cash generation, ensuring long-term stability.

We will also deepen our investments in branded products, including Animal Nutrition and Health, reinforcing our leadership in a variety of categories. We remain committed to brand-building, value innovations, and enhanced marketing investments to support greater growth in the coming years.

“

We need to rise above the changes at hand and build, shape, and cultivate success with purpose and precision.

All of these efforts emphasize our dedication to navigate the transitions that so readily come with change. This includes an eager willingness to drive new success, no matter the challenge.

We need to rise above the changes at hand and build, shape, and cultivate success with purpose and precision. We have laid the groundwork, and now, with our best talent, strongest brands, and most ambitious strategies in play, we are poised to seize every new opportunity in the years ahead. Thank you for your continued trust and support.